In an ever-tightening economic climate, finding ways to cut costs so save money on unavoidable expenses is not just smart—it’s essential. Whether it’s groceries, utility bills, or transportation, there are cost saving strategies you can adopt right now to help keep your finances in check. Here are 5 ways to do just that.

Love your movies and shows? Trust us, we do too, but when you are subscribed to Netflix, Hulu, HBO, Disney Plus+, Apple TV, Paramout Plus, Peacock, Amazon, Starz, it REALLY ads up. Instead, choose you top 2 and stick with it. It’s also worth noting many of these services have overlapping movies and shows so you aren’t missing much. Once you cut down, your bill goes from 100+ to $30 if you opt for say Netflix + Hulu…saving you at least $840 bucks a year!

If you are the type that turns all the lights on or likes to sleep with the fan on, this is for you! Easiest way to save money on these habits is by switching out all your bulbs for energy efficient ones and getting an energy efficient fan (or in my case a white noise machine). I personally did this, and my bill went from 150 a month to 98. That’s over $624 bucks that I saved on a super simple switch without having to change my habits.

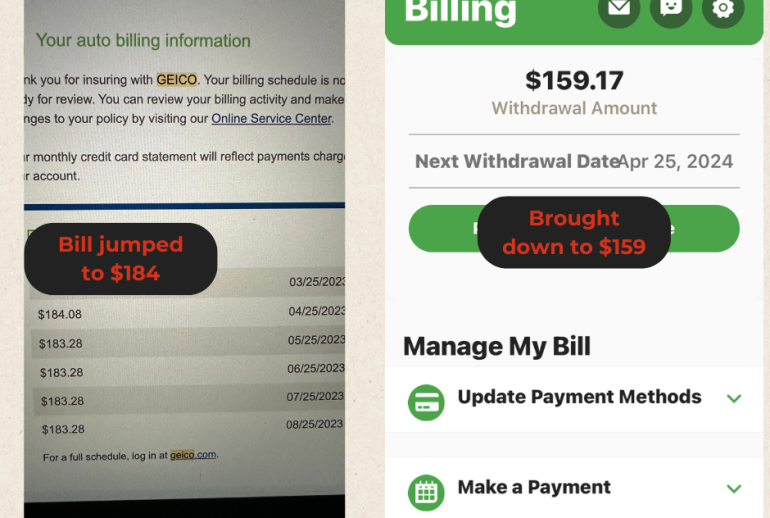

Personally, I’m salty about car insurance because I have not had to use it in over 15 years but still have to pay like a sucker. So, what’s the best way to save on car insurance? All you have to do is compare rates and if you’re lucky, you will find a cheaper insurance with the same coverage. Pro tip: LOOK at what you are paying for and MAKING SURE you are getting discounts. Most places (looking at you Geico) won’t automatically give you discounts and I learned this the hard way. Here’s what to look out for to save money on car insurance:

By doing the above, I was able to bring down my car insurance payment from 183.00 to 159.00. This comes out to saving $288 for the year, so haggling for a better rate is worth it.

Not all of us have Tesla’s, so gas is one of those unavoidable expenses we all must endure. So, how can you save on gas? There are several ways you can and should do every time you get gas:

Minimum gas savings: If you simply change where you get gas from say Chevron and get either Costco or Vons Gas, for a car with a 12-gallon tank, saving approximately $0.40 per gallon at Costco would result in savings of about $4.80 each time you fill up the tank. In a year, with weekly fill-ups, this equals an annual savings of around $249.

When fast-food was cheap, it used to make sense to get food from Carls Jr. or Mcdonalds. Now, a simple lunch normally costs $15-20 and if you do this 5 days a week for lunch, that’s $400 bucks a month just on lunch! Instead, start implementing frugal grocery shopping tips to save money and start meal prepping. Some of my go-to’s are grilled chicken, prepping salads, and premaking several burritos and freezing them to eat later. Your bill as well as the health of your body and wallet will thank you. This lunch switch alone will save you $200 a month which is $2,400 a year…wow!

So around how much are you saving if you start to implement the tips above? When you add it all up, you save a MINIMUM of $4,401 bucks! The best part about it is every tip mentioned is practical, not ridiculous, you won’t feel the “pinch” of a lifestyle change, and your savings situation will improve dramatically.

By implementing these money-saving strategies, you can take control of your finances and cut costs to save money on your monthly expenses. Each small change can add up to substantial savings over time, helping you to achieve a more secure financial future. Save Sensei out!

savesensei1@gmail.com